Divorce brings a lot of challenges, and one of the challenges that can be most confusing is determining child support. There are so many questions that swirl around in a divorce: How is child support calculated in Indiana? When do you start paying child support? When does child support stop in Indiana? What will child support mean for my taxes?

Fortunately, you don’t have to figure all this out alone. Working with an experienced divorce lawyer will help you ensure that your child support agreement is fair and accurate, keeping your child’s best interests in mind.

Read on to get the answers to some of your questions about child support in Indiana.

How is Child Support Calculated in Indiana?

Typically, the noncustodial parent is required to pay child support to the parent who has physical custody of the child. This ensures that both of the child’s parents carry the financial responsibilities that come with raising a child.

However, the custodial parent doesn’t set the amount paid by the noncustodial parent. Several factors go into determining the amount of the child support obligation.

However, the custodial parent doesn’t set the amount paid by the noncustodial parent. Several factors go into determining the amount of the child support obligation.

The primary factors are:

- How much each parent earns

- How much each parent is required to spend on other obligations such as daycare and health insurance for the child only

- How much time the child spends with each parent

- The child’s special needs, if any

Per the Indiana Supreme Court’s Child Support Rules and Guidelines, these factors are used to determine how much is paid by the noncustodial parent.

What Will You Need to Present to the Court?

Each parent’s weekly gross income must be presented to the court for the court to determine how much child support will be owed.

This income amount will include, but may not be limited to:

- Salary/Wages

- Rental Income

- Commission

- Social Security or Veterans’ Benefits

- Royalties

- Dividends

- Use of a company car, company housing, and any stipends

If a parent isn’t currently receiving an income, it’s possible that support may be based on earning potential rather than actual income. This application is intended to block parents from avoiding their child support obligation by not working, or by working at a lower capacity.

If a parent isn’t currently receiving an income, it’s possible that support may be based on earning potential rather than actual income. This application is intended to block parents from avoiding their child support obligation by not working, or by working at a lower capacity.

Once you’ve determined your income amount, your adjusted weekly income will be determined. This takes into account very specific weekly expenses such as daycare, the child’s health insurance, child support to other children as well as spousal support. Indiana’s Child Support Obligation Worksheet will be completed by your attorney.

How Does the Court Determine the Amount of Support?

Once all of the necessary adjustments to each parent’s weekly income have been determined and entered into the Child Support Obligation Worksheet, the calculation is completed.

However, if at a hearing, the judge decides that this amount is unfair for either party, the court may make any adjustments deemed reasonable. This is when it’s really helpful to work with an experienced family law attorney who can help you ensure that the child support is sufficient to support your child and allow the payor to have income left.

When Does Child Support Start and Stop?

As soon as the court orders a parent to start paying child support, they are legally obligated to do so. Of course, there can be modifications made to the support order over time, depending on changes to income and circumstances. An attorney can provide guidance if you believe that your child support order should be changed.

As soon as the court orders a parent to start paying child support, they are legally obligated to do so. Of course, there can be modifications made to the support order over time, depending on changes to income and circumstances. An attorney can provide guidance if you believe that your child support order should be changed.

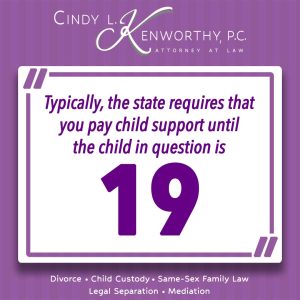

When does child support stop in Indiana? In most cases, the state requires that you pay child support until your child is 19 years old. However, there are a few instances in which you might stop paying child support before then. This stoppage involves the emancipation of your child.

Your child is considered emancipated before their 19th birthday if they are:

- On active duty in the military

- No longer under a parent’s care

- At least 18 years old and hasn’t attended school in four months, and is capable of supporting themself

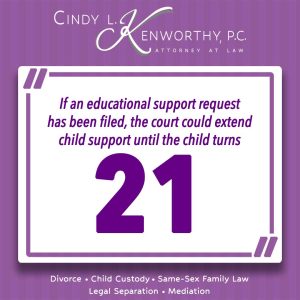

There are also circumstances under which you could be required to pay beyond your child’s 19th birthday. If an educational support request has been filed after a hearing, or by an agreement with the other parent, you could be ordered to pay post-secondary education expenses. Additionally, if your child is mentally or physically incapacitated, you may be responsible for supporting them indefinitely.

Claiming A Child On Your Tax Return

Typically, in finalizing a divorce or a paternity case, a determination of tax benefits related to a child and which party will receive that benefit will be resolved.

Typically, in finalizing a divorce or a paternity case, a determination of tax benefits related to a child and which party will receive that benefit will be resolved.

Several factors help make this determination, including:

- The parent’s income

- The value of claiming the child on the parent’s taxes

- The child’s age

- The percentage of support for which each parent is responsible

There is another way in which a parent’s tax refund could be impacted by child support. If the parent paying child support is delinquent in their payments, their income tax refund could be redirected to help repay their child support arrearage.

Get Answers to All Your Child Support Questions

It’s challenging to navigate the intricacies of child support without an experienced attorney on your side. Cindy L. Kenworthy, P.C. is ready to help you get the child support outcome you want. Contact the firm online to schedule a meeting with an attorney or call 317-516-0515.